Amsterdam, 20 April 2022 – Heineken N.V. (EURONEXT: HEIA; OTCQX: HEINY) publishes its trading update for the first quarter of 2022.

Key Highlights

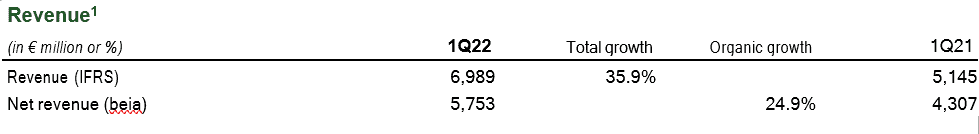

- Revenue growth 35.9%

- Net revenue (beia) organic growth 24.9%; per hectolitre 18.3%

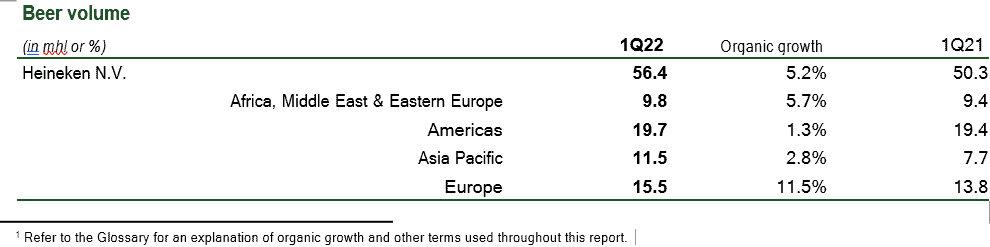

- Beer volume 5.2% organic growth; premium volume 6.3% organically

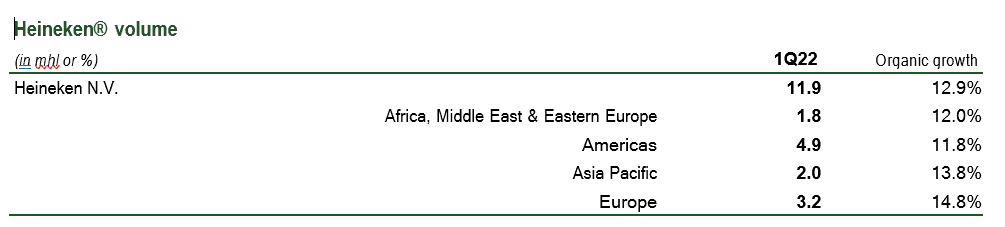

- Heineken® volume growth 12.9%

- Outlook for full year 2022 unchanged

CEO Statement

DOLF VAN DEN BRINK, CHAIRMAN OF THE EXECUTIVE BOARD / CEO, COMMENTED:

“We had a solid start to the year, in line with our expectations, especially benefitting from strong channel mix from the partial on-trade recovery of Europe and assertive pricing across all regions. We continue to make progress on EverGreen and launched Heineken® Silver in Europe to drive premiumisation at scale. Looking ahead, we see more macro- economic uncertainty and expect significant additional inflationary headwinds putting further pressure on our cost base. We will take additional actions including pricing to manage these challenges whilst we continue to invest in superior, balanced growth and sustainable value creation.”

Driving Superior Growth

Revenue for the first quarter of 2022 was €6,989 million (2021: €5,145 million). Net revenue (beia) was €5,753 million and increased by 24.9% organically, with total consolidated volume growing by 5.7% and net revenue (beia) per hectolitre up 18.3%. The latter was driven by assertive pricing and premiumisation across all regions, as well as a positive channel mix effect, particularly in Europe. Currency translation positively impacted net revenue (beia) by €186 million or 4.3%, mainly driven by the Brazilian Real, the Mexican Peso and the Vietnamese Dong. The consolidation of United Breweries Limited (UBL) in India positively impacted net revenue (beia) by €200 million or 4.6%.

Beer volume grew 5.2% organically versus last year and came 2.8% ahead of 2019 on an organic basis. All regions contributed to the growth, especially Europe, given the low base last year due to the COVID-related restrictions in the on-trade. Asia Pacific returned to growth following the lockdown in the second part of last year. The Americas region recorded modest growth whilst Africa, Middle East & Eastern Europe continued its positive momentum.

DRIVING PREMIUMISATION AT SCALE, LED BY HEINEKEN®

Premium beer volume grew 6.3%, outperforming the portfolio in the majority of our markets in the first three months of 2022. Our growth in premium is driven by Heineken®, which grew 12.9% in volume, significantly outperforming the total beer market and ahead of 2019 by close to one-third. Volume grew double-digits across all regions and in more than 45 markets. Growth was mainly driven by Brazil, China, the Netherlands, Spain, Ireland, Italy, the UK, Portugal, Nigeria, and the United Arab Emirates. Heineken® 0.0 grew in the twenties with strong momentum in Brazil, Mexico, the USA, Chile and South Korea. Heineken® Silver continued its strong growth in Vietnam and China. We also launched Heineken® Silver in Europe, reflecting our increased focus on consumers who are looking for more differentiated taste profiles and to drive further premiumisation. We kicked off in March with the first virtual beer launch in the Metaverse and in April we entered the next phase with the real launch, making Heineken® Silver available all over Europe. Overall, Heineken® Silver grew more than eighty percent.

BUILD A FUTURE-FIT DIGITAL ROUTE-TO-CONSUMER

During the first quarter of 2022, we have continued to build a future-fit digital route-to-consumer and scale up our e- commerce platforms:

- Our business-to-business digital (eB2B) platforms captured more than €1.3 billion in digital sales value, more than 4x last year, driven by strong growth in Vietnam, Nigeria, Mexico, Brazil, the UK and France. We now have more than 400,000 active customers, more than 2.5x last year.

- The net revenue of Beerwulf, our direct-to-consumer (D2C) platform in Europe, was 75% ahead of pre-pandemic levels, despite a shift in consumption this year from in-home to the on-trade. The active customer base for our home draught systems is more than 50% ahead of pre-pandemic levels.

Regional Overview

AFRICA, MIDDLE EAST & EASTERN EUROPE

- Net revenue (beia) grew 24.5% organically, with total consolidated volume up 5.8% and net revenue (beia) per hectolitre up 17.7%, driven by strong pricing across the region, particularly in Nigeria, and premiumisation.

- Beer volume increased organically by 5.7% with most markets contributing and a particular strong performance in South Africa and Ethiopia. Premium beer volume grew in the low-teens, led by Heineken®. Most markets in the region have fully recovered relative to 2019.

- In Nigeria, total volume decreased by a mid-single-digit due to capacity constraints leading to low stocks during the peak season. The premium portfolio grew by more than thirty percent, led by Heineken®, Tiger and Desperados.

- In South Africa, total volume grew in the high-teens, ahead of the market, benefitting from the relatively low base given the alcohol ban in January of last year. The growth was led by Windhoek and Amstel. We are in the process of obtaining the regulatory approvals to complete the proposed transaction with Distell Group Holdings Limited and Namibia Breweries Limited.

- In Ethiopia, beer volume grew in the high-twenties, ahead of the market, led by Harar and Bedele.

- In Egypt, total volume grew in the low-twenties, led by the growth of the non-alcoholic portfolio. Beer volume remains below 2019.

- On 28 March, HEINEKEN announced the decision to leave Russia.

AMERICAS

- Net revenue (beia) grew 10.7% organically, with total consolidated volume down 1.9% and net revenue (beia) per hectolitre up 13.2%, led by pricing in Brazil and Mexico and continued premiumisation.

- Beer volume increased organically by 1.3% in the quarter led by Brazil and Mexico, and was broadly in line with 2019. Our premium portfolio grew by a high-single-digit, led by Heineken® and Dos Equis. Non-beer volume declined 57.7% following the delisting of low-margin PET soft drinks in Brazil.

- In Mexico, beer volume grew by a low-single-digit, held back by the timing of Easter relative to last year. Premium beer volume increased in the low-teens, led by Amstel Ultra.

- In Brazil, beer volume grew by a low-single-digit, ahead of the market. Our premium and mainstream portfolio grew by double-digits, led by Heineken®, Amstel and the recent introduction of Tiger. The economy brands declined in the double-digits.

- In the USA, beer volume was down by a mid-single-digit. Heineken® was down in the low-teens, predominantly driven by supply chain disruptions and partly by the softer market. Dos Equis grew in the mid-teens, benefitting from the on-trade growth and the continued strong performance of Dos Equis core and its line extensions.

ASIA PACIFIC

- Net revenue (beia) grew 9.2% organically, with total consolidated volume up 2.8% and net revenue (beia) per hectolitre up 6.3%, mainly driven by pricing across the region, particularly in Malaysia. The consolidation of UBL in India positively impacted net revenue (beia) by €200 million or 4.6%.

- Beer volume increased organically by 2.8% versus last year, led by the strong recovery of Cambodia and Malaysia, ahead of 2019 levels. The premium portfolio declined by a low-single-digit driven by Vietnam, while staying ahead of 2019 by a high-single-digit.

- In Vietnam, beer volume declined by a low-single-digit due to the timing of the Tet and some continued on-trade restrictions at the start of the year. We continued to strengthen our leadership position in the market. Relative to 2019, beer volume was ahead in the mid-twenties. Heineken® Silver grew by more than fifty percent compared to last year.

- In India, beer volume grew by a high-single-digit, outperforming the market. UBL experienced progressive growth during the quarter with the declining impact of the COVID omicron variant.

- In China, Heineken® grew in the forties, with a strong performance of Heineken® Original and Heineken® Silver.

- In Cambodia, beer volume grew in the mid-twenties, ahead of the market and ahead of 2019. The strong growth benefitted from the relatively low base given the national lockdown implemented in March last year. Premium beer volume grew in the thirties, led by Tiger.

- In Malaysia, beer volume increased in the low-twenties versus last year and ahead of 2019, benefitting from relatively lower COVID-related restrictions in the market. The premium portfolio outperformed, led by Heineken®.

- In Indonesia, beer volume grew by a high-single-digit, ahead of the market, benefitting from relatively lower COVID- related restrictions versus last year. Beer volume remains behind 2019 in the low-teens. The premium portfolio grew in the low-teens and is ahead of 2019 levels, driven by Heineken®.

EUROPE

- Net revenue (beia) grew 46.1% organically, with total consolidated volume up 16.9%, benefitting from the partial recovery of the on-trade, and net revenue (beia) per hectolitre up 29.3%, driven by positive channel and premiumisation effects and by pricing.

- Beer volume grew organically by 11.5%, benefitting from the partial recovery of the on-trade, remaining below 2019 by a low-single-digit. We outperformed the market in most of our operations. On-trade beer volume almost tripled relative to last year, but remained behind 2019 in the high-teens. Off-trade volume declined in the low-teens versus last year, staying ahead of 2019 by a high-single digit. Our premium portfolio grew in the low-teens. We launched Heineken® Silver across all of Europe in April.

- In the UK, total volume grew in the forties, driven by the on-trade recovery. Our premium portfolio grew in the thirties, led by Birra Moretti, Desperados and Old Mout.

- In France, total volume increased in the twenties, led by the recovery of third-party volume in our wholesale business. Our premium beer portfolio grew in the mid-teens, led by Desperados.

- In Spain, beer volume grew by a high-single-digit, benefitting from lower restrictions in the on-trade although held back by a national strike of truck drivers at the end of the quarter. Our premium portfolio grew in low-teens, led by El Águila and Heineken®.

- In Italy, total volume increased in the twenties, also benefitting from less COVID-related restrictions in the on-trade. The premium portfolio grew by a high-single-digit, driven by the strong performance of Birra Messina and Ichnusa.

- In Poland, beer volume was down by a mid-single-digit in a declining market. The premium portfolio declined in the low-teens.

- In the Netherlands, beer volume grew in the thirties following the reopening of the on-trade during February. Our premium portfolio grew in the thirties, led by Birra Moretti and Texels.

Reported Net Profit

The reported net profit for the first three months of 2022 was €417 million (2021: €168 million). The net profit growth was driven by the top-line growth, with the partial recovery of the on-trade in Europe as the main factor. The reported net profit does not include the announced impairment and other non-cash exceptional charges of approximately €0.4 billion related to the decision to transfer the ownership of our business in Russia. A further update will follow with the half-year results.

Business Outlook

The war in Ukraine has brought additional uncertainty to the global economic outlook and commodity markets. We expect mounting inflationary pressures to impact household disposable income and a consequent risk to beer consumption later in the year. While we benefit from hedges taken in 2021, further cost pressures are emerging from rising input costs, supply chain challenges, and from our decision to leave Russia. We will take additional actions and maintain our guidance of a stable to modest sequential improvement in operating profit margin (beia) in 2022.

Translational Currency Calculated Impact

Based on the impact to date, and applying spot rates of 14 April 2022 to the 2021 financial results as a baseline for the remainder of the year, we calculate a positive currency translational impact of approximately €1,150 million in net revenue (beia), €160 million at operating profit (beia) and €100 million at net profit (beia).